Unbundling electricity distribution and opening up the market to multiple sellers is the next hangover the South African economy is going to have to endure, and municipal revenue is currently the biggest headache.

Most households in South Africa (SA) are keen to replace their electricity bill with something more favourable. But before we put all the Eskom and municipal supply pains in the box to the left and embrace a liberalised market, Mzansi needs to reckon with the truth of the matter – which is that reselling electricity is the main source of revenue for many municipalities.

Read more: Profit over people: A spotlight on South Africa’s contested energy landscape

But unfortunately, municipalities have the biggest unpaid Eskom bills, which is a hangover of decades of centralised, heavily subsidised electrons. Why? Because mining needed to be profitable and the apartheid government wanted to attract more mineral extraction investment.

advertisement

Don’t want to see this? Remove ads

The growth never materialised due to international sanctions and economic stagnation. By the early 1990s, Eskom was left with a massive surplus of generation capacity (relative to the user market size) and zero storage options – so they sold it on the cheap.

In 2008, after 12 years of rapid grid expansion and some dodgy dealmaking with the aluminium smelters, that surplus tipped to a deficit and investment was needed to build out more power.

Nightmare scenario

Which brings us to now, with a legion of independent power producers who need room in the market, and a National Energy Regulator (Nersa) rushing to write the rules that will let them in.

The draft Rules for Electricity Trading published by Nersa in October 2025 are designed to break the monopoly and allow private traders to use the grid. But for municipalities, these rules threaten to sever the artery that keeps them alive: the ability to mark-up electricity prices to fund other services.

Read more: Eskom awards contract to develop a virtual wheeling platform amid regulatory tension

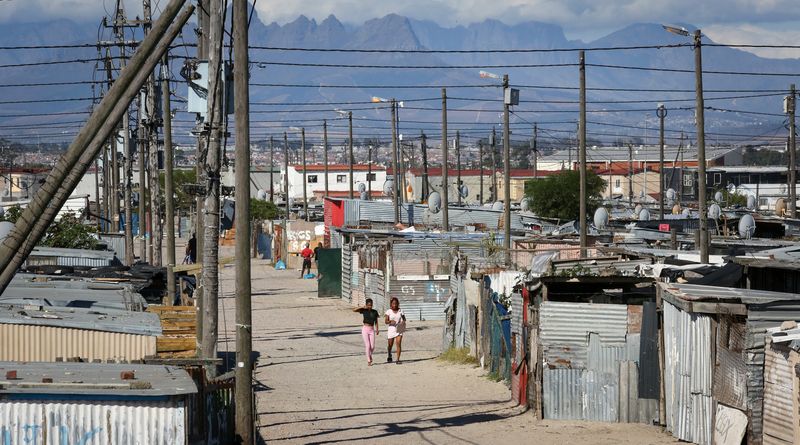

“If you know how it works, your metropolitans will be significantly faster [to adapt to the new rules] than the 140 rural [municipalities], which means we then embark on a reform that’s built on inequity,” Christo Nicholls, CEO of Utility Consulting Solutions told Daily Maverick.

Nicholls consults with cash-constrained municipalities to help find sustainable economic models and warns that the one-size-fits-all approach ignores the vast chasm between the City of Cape Town – which is actively seeking independence from Eskom – and rural municipalities that are barely holding their financial heads above water.

“In rural municipalities, the electricity income constitutes about 34% to 40% of total income,” he explains. “And out of that, a fair percentage gets used to actually cross-subsidise the other services.”